Let’s cut to the chase: upgrading your HVAC system can save you money on energy bills and taxes. But navigating federal incentives requires knowing the right efficiency benchmarks. The key question isn’t just about saving energy—it’s about how to maximize your tax credit without overspending. Here’s what you need to know.

The Short Answer: SEER Ratings and Tax Credit Eligibility

To qualify for the federal tax credit under the Inflation Reduction Act (IRA), your new air conditioner or heat pump must meet specific efficiency criteria:

- Central Air Conditioners: Minimum SEER2 16 (equivalent to the older SEER 18-20).

- Heat Pumps: Minimum SEER2 15.2 and HSPF2 7.5.

These standards apply to systems installed between January 1, 2023, and December 31, 2032. Qualifying systems earn a tax credit of 30% of the installation cost, up to $2,000 annually.

Breaking Down SEER: Why Efficiency Matters

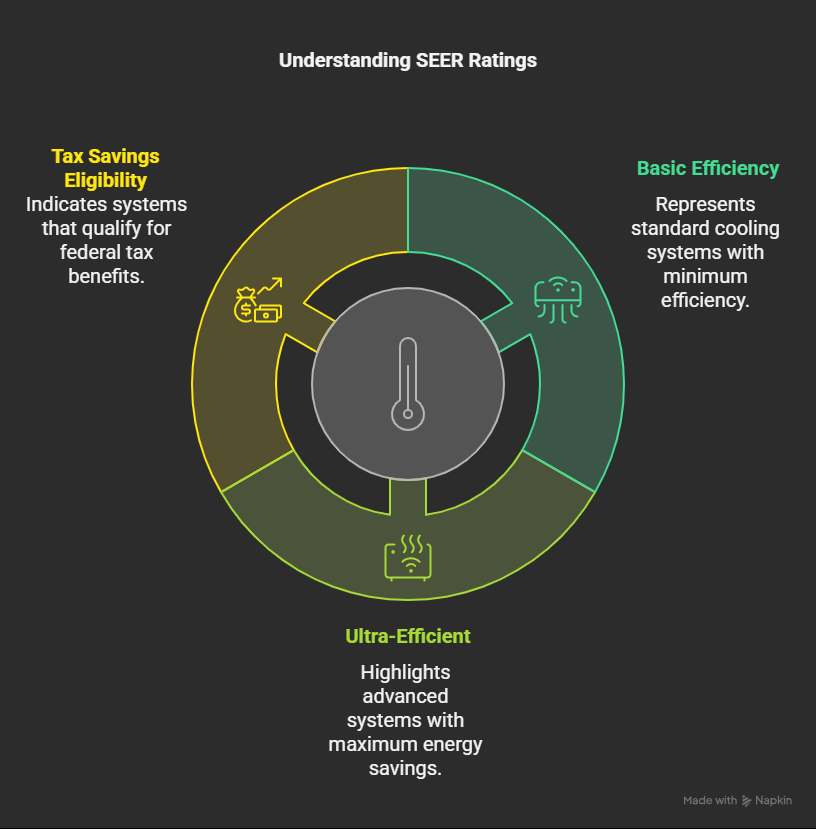

SEER (Seasonal Energy Efficiency Ratio) measures how much cooling a system delivers per watt of electricity. The higher the SEER, the less energy it wastes. Modern systems range from SEER2 13 (basic) to SEER2 26 (ultra-efficient), but only those meeting federal thresholds unlock tax savings.

Pro Tip: SEER2, introduced in 2023, reflects updated testing conditions for real-world performance. Think of it as SEER’s more accurate sibling.

How to Qualify for the Tax Credit

- Choose the Right Equipment: Verify your system’s SEER2 rating with the manufacturer or contractor.

- Keep Documentation: Save your receipt and the Manufacturer’s Certification Statement (confirming efficiency specs).

- Install Correctly: Hire a licensed professional—improper installation can void eligibility.

Check the Energy Star Certified Products Database for pre-vetted systems.

Tax Credit vs. Rebate: What’s the Difference?

- Tax Credit: Reduces your federal tax bill dollar-for-dollar (e.g., a

- 2,000creditcutstaxesby

- 2,000creditcutstaxesby2,000).

- Rebate: Instant discount at purchase, often offered by states or utilities.

Some states, like California and New York, stack rebates with federal credits. Search Database of State Incentives for Renewables & Efficiency for local deals.

SEER Rating Comparison Table

| System Type | Minimum SEER2 | Tax Credit | Annual Energy Savings* |

| Central AC | 16 | 30% | 300−300−600 |

| Heat Pump | 15.2 | 30% | 500−500−1,000 |

| Ductless Mini-Split | 15.2 | 30% | 200−200−450 |

*Savings vary by climate and usage.

“Is a Higher SEER Worth the Extra Cost?”

A SEER2 20 system costs ~20% more than a SEER2 16 model. But over 10-15 years, the upgraded unit could save $1,500+ in energy costs—plus the 30% tax credit softens the upfront hit. Use the AC Savings Calculator to crunch your numbers.

Common Pitfalls to Avoid

- Ignoring Installation Quality: Even a SEER2 20 system underperforms if ductwork leaks.

- Missing Deadlines: Installations must occur within the tax year you claim the credit.

- Overlooking State Programs: Pair federal credits with local rebates for maximum savings.

Final Steps to Claim Your Credit

- Confirm your system’s eligibility via the Energy Star product list.

- File IRS Form 5695 with your tax return.

- Consult a tax pro if you’re unsure about eligibility.

Ready to Upgrade?

If your AC is older than 10 years (SEER 8-12), replacing it with a SEER2 16+ system could slash energy use by 40%. Pair that with a $2,000 tax credit, and the math speaks for itself.

Still hesitant? Compare quotes from ENERGY STAR-certified contractors to find the best deal. Your wallet—and the planet—will thank you.