What if I told you there’s a way to slash your energy bills and your tax bill at the same time? Sounds like a no-brainer, right? That’s exactly what the federal solar tax credit does. And yes, it’s still a thing—just super misunderstood.

Here’s the deal: there’s no federal rebate check coming your way, but there is a sweet 30% tax credit if you install solar. That’s like the government giving you a high-five (and some serious cash back) for going green.

In my opinion? If you’ve even been thinking about solar, now’s the time to jump. This perk starts phasing out in 2033—and trust me, you don’t want to miss out.

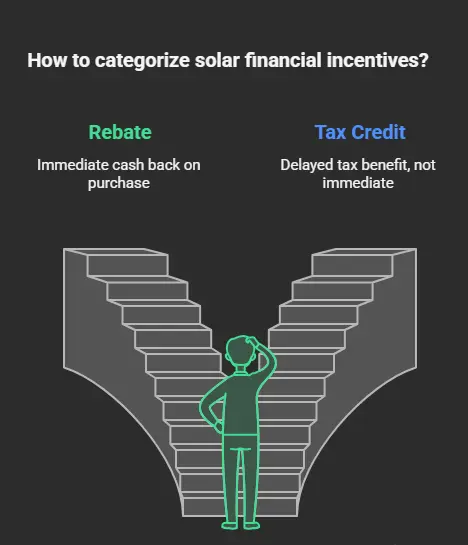

Rebate vs. Tax Credit: Why Terminology Matters

Let’s clear this up real quick—because I hear it all the time.

People ask, “Is there a federal solar rebate?” and honestly, that’s kind of a mix-up in terminology.

- A rebate means you get money back right away—like your utility company handing you $500 off your solar setup on the spot.

- What the federal government offers isn’t that. It’s the Federal Solar Investment Tax Credit (ITC)—and it’s not an instant discount.

Instead, it knocks 30% off your tax bill when you file with the IRS. Still awesome, just in a different way.

Even the U.S. Department of Energy had to step in and clarify: the ITC reduces your federal income tax liability dollar-for-dollar.

So yeah—it’s a serious tax break. Just not an up-front cash deal.

Bottom line: It’s not a rebate in the traditional sense. Knowing the difference can save you a lot of head-scratching later.

The 2025 Update: 30% Tax Credit Stays Put

Thanks to the Inflation Reduction Act, the ITC is stronger than ever. Here’s what the timeline looks like:

| Year | Tax Credit Percentage |

| 2023–2032 | 30% |

| 2033 | 26% |

| 2034 | 22% |

| 2035 | Expires (residential) |

What’s Covered? Breaking Down Eligible Solar Expenses

Panels, labor, wiring, and even batteries installed with your system, as outlined in the IRS Residential Clean Energy Credit guidelines. Under the Residential Clean Energy Credit, you can claim 30% of nearly everything you spend to get your solar system up and running.

✅ Covered Expenses:

- Solar Panels – Whether monocrystalline or polycrystalline, the full cost qualifies.

- Labor Costs – Including:

- Contractor fees

- Permit and inspection fees

- Roof prep (e.g., structural support)

- Contractor fees

- Wiring and Hardware – Like:

- Inverters

- Mounting racks

- Conduits and breakers

- Inverters

- Batteries (If Installed With Panels) – Like the Tesla Powerwall. Installed later? Not eligible.

- Incidental Costs – Including:

- Sales tax

- Shipping and delivery fees

- Sales tax

❌ Not Covered:

- Landscaping or tree removal

- Post-installation maintenance

- Leased solar systems (you must own the system)

Example: Sarah’s $30,000 Solar Win

Sarah, a homeowner in Austin, Texas, went solar last year. Here’s her cost breakdown:

| Expense | Cost |

| Solar panels | $18,000 |

| Labor & permits | $8,500 |

| Inverter & wiring | $2,500 |

| Battery (with panels) | $1,000 |

| Total | $30,000 |

Credit Calculation:

👉 30% of $30,000 = $9,000 tax credit

“It felt like hitting the jackpot,” Sarah says. “That $9,000 credit covered a semester of my kid’s college tuition.”

Pro Tip: Save every receipt—small stuff like mounting racks and permits add up!

Who Qualifies? (Hint: Ownership is Key)

To be eligible for the credit, you must:

- ✅ Own your home (renters don’t qualify)

- ✅ Use new equipment (no refurbished systems)

- ✅ Install the system before Dec. 31, 2034

- ✅ Own the system (not lease it)

Bonus: Landlords and businesses can qualify too!

Roll-Over Example:

If your tax bill is $5,000 and your credit is $6,000, the leftover $1,000 rolls into next year.

How to Claim Your Credit: A Foolproof 3-Step Plan

Step 1: File IRS Form 5695

This is where you officially report your solar expenses.

- Download it from the IRS website

- Most tax software includes it automatically (e.g., TurboTax, H&R Block)

Tips:

- Submit it with your Form 1040

- Complete Part I for residential energy credits

Step 2: Calculate Your Credit

Add up all qualifying expenses (equipment, labor, and incidental costs).

Example:

Total installation cost = $25,000

👉 30% of $25,000 = $7,500 tax credit

Step 3: Apply the Credit

- The credit reduces your tax dollar-for-dollar

- It’s non-refundable, but unused portions roll forward up to 5 years

Example:

Tax bill = $6,000

Credit = $7,500

You owe $0 this year, and roll the extra $1,500 into next year!

Pro Tip: Stack it with state incentives like California’s SGIP rebate to save even more. while New York’s NY-Sun offers cash per watt installed.

Bonus: Record-Keeping Checklist

Hang on to these documents for at least 3 years after filing:

- 🧾 Itemized receipts for equipment and labor

- 🏗️ Proof of installation date

- 📋 Warranties and system specs

Real-Life Example: John’s Win in California

John spent $28,000 on his solar system.

- Claimed a $8,400 credit (30%)

- It slashed his tax bill to $0

- Rolled the leftover $1,200 into the next year

“It was smoother than I expected,” John says.

Myths Busted: Separating Fact from Fiction

❌ “The credit expired in 2022.”

✔️ Nope! It’s valid through 2034 (phases out starting 2033).

❌ “Batteries don’t count.”

✔️ They do—if installed with your system.

❌ “It’s a rebate.”

✔️ Nope—it’s a tax credit (say it with me!).

What’s Next for Solar Incentives?

The future looks bright—even beyond 2035. Some state programs are stepping up:

While the ITC’s future post-2035 is hazy, states are stepping up. Florida now offers sales tax exemptions, and Illinois just launched a Solar for All program for low-income households. Plus, tech advances mean today’s panels are 50% cheaper than a decade ago—a trend highlighted in the Solar Energy Industries Association’s 2025 Market Report—making solar a smarter bet than ever.

Plus, solar panel prices have dropped nearly 50% in the last decade.

Final Take: Don’t Let 2032 Sneak Up on You

The 30% tax credit is a limited-time offer. Combine it with local programs, and your solar setup could pay for itself in under a decade.

Ready to act?

- ✅ Get a free quote from a certified Energy Star installer

- 💰 Talk to a tax pro to customize your savings

FAQs

Q: Does a vacation home qualify?

A: Yes! Both primary and secondary residences are eligible.

Q: What if I don’t owe taxes this year?

A: Carry the credit forward for up to 5 years.

Q: Can I DIY my installation?

A: Only if you’re a licensed contractor. DIYers miss out otherwise.

Your Turn

Already gone solar? Share your story in the comments.

Still curious? Drop a question—we’re here to help.

Stay sunny, folks. 🌞

Disclaimer: This article is for informational purposes only. For personalized advice, consult a certified tax professional.